Why have EU countries turned out at the junction with a difficult choice of gas transit partners trying to strengthen security of supplies?

In May this year, the European Commission adopted a new European Energy Security Strategy, which was a response to an acute political crisis in Ukraine and emerging threats to security of gas supplies to the EU.

Since then, despite all steps, statements and assurances made by the European Commission, the situation remains complex, not to say that by the end of the year it has worsened. Especially it concerns medium-term prospects for the desirable risk reduction of unstable gas supplies to Europe that are becoming daily less and less optimistic.

It is clear that as we talk about the partners of the EU who are responsible for ensuring supplies, we have to consider countries - gas suppliers as well as countries providing the transit through their territory. They are sharing the responsibility as it takes place within any supply chain. It should be recalled that the European Energy Security Strategy mentioned above completely focused on Russia's role in gas supplies to the EU countries. However, this Security Strategy did not pay necessary attention to responsibility of gas transit countries, especially in the case of Ukraine and those violations of the transit obligations, which has been already committed by that country. However, responsibility of gas transit countries, especially in the case of Ukraine and those violations of transit obligations, which had been already committed by that country, are being ignored in this Security Strategy and it shouldn't.

It is impossible not to recognize that gas transit countries play an equally important role in ensuring the supplies. Transit reliability is similarly essential for maintaining a high level of security of supply. A transit country could be figuratively compared with a drawbridge, which our ancestors were supposed to use often at entrances to medieval castles. They were well aware that even if the road to the castle could be in excellent condition, but such a bridge was out of order or under the control of non-friends, security of supplies to the castle would be a big problem.

The fact that transit countries unreasonably have taken a backseat of the European energy policy regarding security of supply reflects the official position of Brussels encouraged by the transatlantic alliance and some followers among the EU member states. By the way, some of the latter are transit service providers themselves for the EU gas market. As a result, it continues to remain silent on the contribution of transit countries in ensuring security of supply, especially if it is negative.

Supply risks related to gas transit countries in particular Ukraine deserve much greater attention

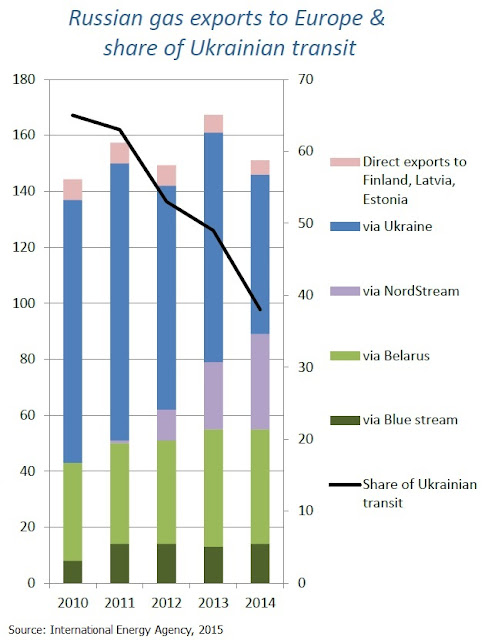

Ask yourself the question what country is the biggest and the most difficult gas transit service provider to the EU? It would not be easy to find anyone among the active population in our countries, who would not know an answer that it is Ukraine.

A close political association between Kiev and Brussels, constant guardianship of the Ukraine's events under supervision of the Washington Administration, recurrent "winter gas packages", etc., all together it serves the PR-campaign creating an image of Ukraine as an absolutely important and, it might even seem, an irreplaceable transit country for supplying gas from Russia.

There are, probably, those among us who could not at once name another transit country for Russian gas. It is Belarus, through which European consumers, especially in Poland and Germany also receive big volumes of gas from Russia. In 2014, Russian gas transit through the territory of Belarus will amount to 45.4 bcm. What is more, unlike Ukraine, this transit route is surely quiet - there are neither problems, nor PR actions relating to the Yamal–Europe pipeline in Belarus. As the phrase goes, "Good business does not go on amidst the hustle and bustle".

However, this expression is not about Ukraine, where shocking news around economic reality and business relationship appear to be very common. Firstly, one may recall that now Kiev refuses to repay sovereign debt by 3 billion USD to Moscow.

Secondly, three months ago, Ukraine and Russia signed a protocol ensuring supplies of gas to Ukraine at market prices for the entire winter season until the end of the first quarter of 2016. It is very important for the security of supplies of Russian gas via Ukraine to the EU. With that in mind, the European Commission acted as a mediator in the multiple dispute-settlement talks that had started long ago in March 2015. Nevertheless, within only two months of signing this agreement, on November 25 Russian company Gazprom stopped supplying gas because company Naftogaz of Ukraine did not pay in advance for the deliveries as it was envisaged by the winter deal. Although under this trilateral agreement, Russia reduced the price it charged Ukraine to the same level granted to neighboring countries, from 251 USD per 1,000 cubic meters to about 230 USD.

In this regard, news agencies quoted the head of Gazprom A. Miller, as saying that "Ukraine's refusal to buy Russian gas threatens a safe gas transit to Europe through Ukraine and gas supplies to Ukraine consumers in the coming winter."

The incident underscores the fact that now the most significant threat to European consumers is embodied in transit risks via Ukraine, but not in the risks relating to the initial supplier. Obviously, even that may be insufficient just to recognize the important role of the risks associated with the transit of gas. It is necessary to judge accurately transit risk levels equally but not lower than risks associated with initial suppliers of gas. Transit risks should not be ultimately ignored (or substituted for some others) while selecting routes of important energy flows to the EU countries.

This observation has meant the necessity of giving separate consideration to both lines of action directed towards ensuring diversification of gas supplies declared by the European Commission including initial gas suppliers and gas transit service providers or gas transit routes.

The European Commission still has been putting in place quite modest actions to diversify gas supply routes

In fact, there is only one project in the medium-term plans of the European Commission to create outside the EU a new transit route for gas supplies to Europe. It is frequently mentioned TANAP - the Trans-Anatolian Natural Gas Pipeline (Trans-Anadolu Doğalgaz Boru Hattı in Turkish) from Azerbaijan through Georgia and Turkey to Europe planned in 2019 to add to the EU imports 10 bcm of gas, of which 8 bcm will be intended for Italy and one each for Greece and Bulgaria.

A continuing cause of concern is a relatively small capacity of this project in comparison with the volume of gas consumption in the EU. Although TANAP project is considered as a part of the South Gas Corridor, which in the future would be able to provide opportunity of delivering to Europe gas from the Middle East and Central Asia. Nevertheless, it is also admitted that there are still so many interlocking political, economic and technical challenges to be solved achieving these goals. Perhaps it will take even more time to erase most of them than to fulfil the long awaited expedition to the Moon.

It is important that TANAP / the SGC opens a new page in relations between the EU and Turkey, which is going to play the role of one of the leading gas transit service provider to Europe.

Many citizens in the EU countries have recently found out how Turkey has been actively preparing for the role of a transit country when sudden waves of refugees overflowed Europe with the direct Turkish assistance that led many of us here to unpleasant consequences interfering much of a usual way of life.

According to the International Organization for Migration (IOM), this year more than a million migrants and refugees came to Europe. To have a clearer perception of the scope and the depth of this humanitarian crisis it is worth reminding that, in 2014, before the refugee mass exodus into Europe, for example, in Austria number of people with migration background had already accounted for an average of 1,715 million that was 20.4% of the entire population.

Apparently, it is not a proper place to delve into such a dramatic and highly sensitive issue. But, the question that arose consequently: why should not this humanitarian transit have been mutually agreed upon between the EU and the executing country - Turkey?

The practical implication of this was that now almost anyone in Europe hardly would doubt that a poorly controlled transit of migrants and refugee without proper mutual guidance through Turkish territory became a bad prologue to Turkey's introduction as a future gas transit service provider. In other words, this situation reveals that in addition to Ukraine in future the EU may have to include Turkey in the list of difficult gas transit service providers. Indeed, despite some undeniable differences these countries have a great deal in common.

Why does the European Union place itself in a vulnerable situation acting of its sovereign will to make a choice between difficult gas transit service providers?

--- -

.png)